GET TO KNOW US

Based in Chicago, we serve clients nationwide, from Wisconsin to Texas and Florida to Washington.

LEARN WITH US

Join us at a live event to discover more about tax planning, retirement income, wealth management, asset protection and legacy planning.

VISIT WITH US

We use our experience and knowledge to design a specific plan of action that helps you work toward financial independence.

Meet

Scott Tucker

Scott helps families in Chicagoland and beyond with their investment and insurance planning needs. Our focus is on tax-reduction strategies, retirement income planning, risk-adjusted portfolio management, healthcare planning and legacy planning.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Our Services

A Toolkit for Your Retirement Journey

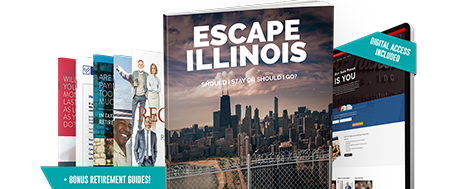

With our complimentary toolkit, you’ll get Scott Tucker’s book, “Escape Illinois: Should I Stay or Should I Go?” This insightful offering explores the financial and lifestyle implications of staying in Illinois versus relocating in retirement.

You’ll also receive resources that help show you how to:

• Transform retirement concerns into confidence.

• Discover and strengthen weak points in your plan.

• Apply small tweaks that can make a big difference.

Frame Your Financial Goals

Your Self-Portrait® is a short quiz designed to give us a full view of your financial picture. This quick quiz helps us better understand your story and how we can best support your goals.

Decode Your Retirement

Our Retirement Decryption Process® simplifies the complexities of planning for your future. We focus on five key areas of your financial life to create a clear, straightforward strategy that helps you move forward with confidence.

Financial Confidence Starts Here

Your retirement journey is unique, and so are your goals. We’re here to help you navigate the complexities of financial planning, so you can focus on what matters most — your family, your priorities and your future.